Everything about Surety Bonds: What Owners Should Know

Capability can be set either for specific jobs or as an aggregate limitation across all of a principal's jobs. Working capital is an element that surety business will assess before underwriting a bond, computed as the difference between a business's present possessions and present liabilities. Because sureties will require compensation from a principal in the occasion of a claim, they would like to know what sort of financial cushion a business needs to repay its financial obligations.

The rate is set based on aspects like you or your service's credit report, the probability of loss or other threats, and your service's monetary statements, like your balance sheet. The surety bond's term is for how long the bond remains in impact. If the term has actually ended, the principal will no longer pay a premium and the surety no longer holds the danger of the bond.

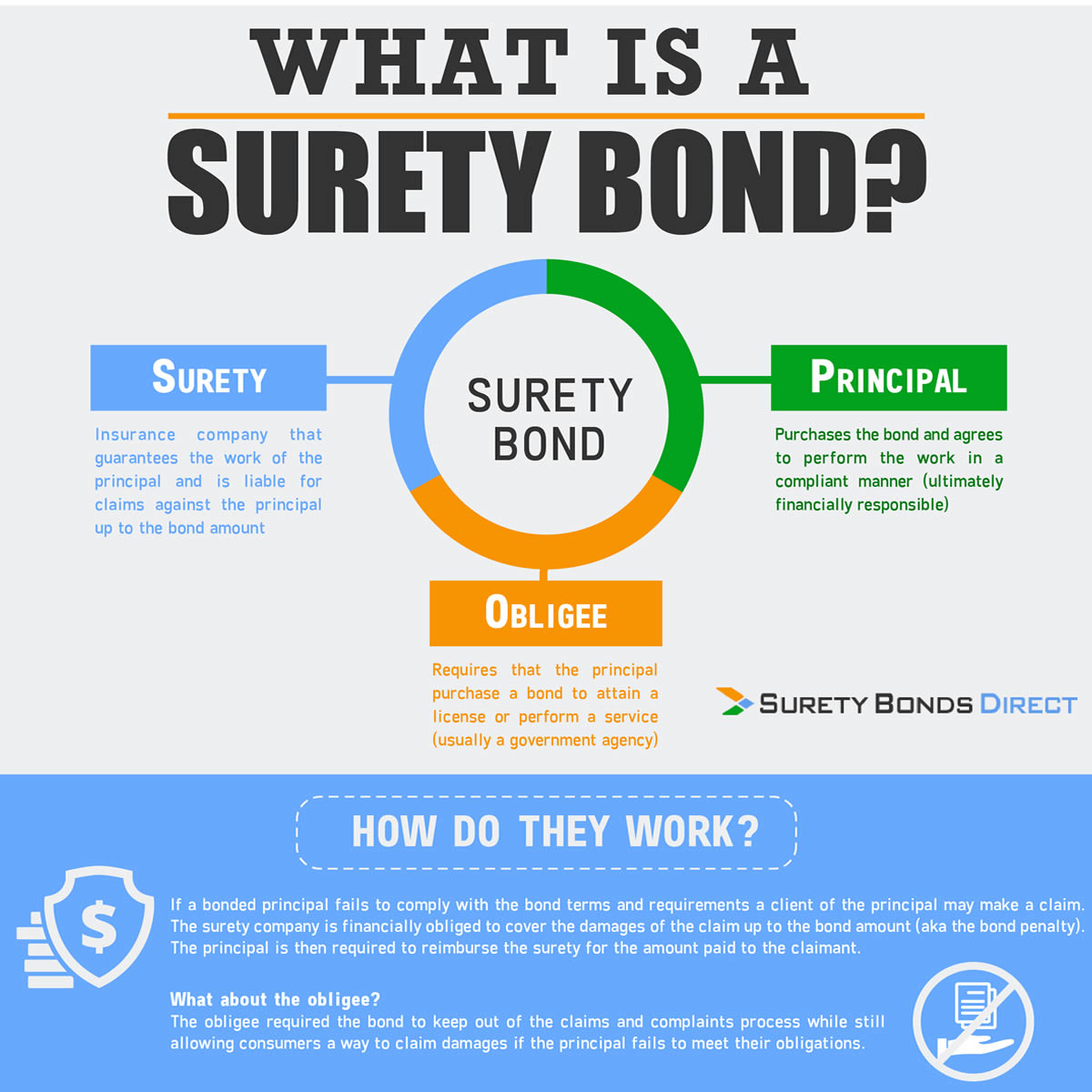

Insurance Insurance and surety bonds are both common forms of threat management in service, and a company may require both in order to operate. And they share one important quality in typical: both insurance coverage policies and surety bonds assist compensate one party on the occasion that something fails. The essential difference is in the celebrations involvedand specifically, which parties bring danger in the contract.

For numerous kinds of protection (e. g. under residential or commercial property insurance), an insurer will repay the insurance policy holder in case of a loss. If someone brings an effective claim against the policyholder (e. g. in a liability claim), the insurance provider will pay out the expense to whoever brought the claim, and the policyholder will not need to contribute economically beyond their premiums and deductible.

Getting My Surety Insurance Fargo - Great North Insurance To Work

The surety bond represents a promise that the principal will satisfy their commitments to the obligee; the surety is involved to guarantee that the obligee will receive settlement if the principal can not in fact cover a payment in the event they stop working to fulfill their legal or legal responsibilities. Ultimately, however, More Discussion Posted Here to pay back the surety in the occasion of a claim, which implies that the financial threat of the arrangement always stays with the principal.